"From our Boston base, we deliver an institutional approach to investing—built on financial pedigree, rigorous governance, and transparent, outcome-oriented execution."

Christopher Perry

Director of Retirement and Institutional Capital

Head of Self-Directed Retirement (SDR) Desk

Chris.Perry@canineinvestments.com

Direct Line: (203) 526-3314

Focus: Self-Directed Retirement Accounts (IRAs, Solo 401(k)s, SEPs)

Chris Perry serves as Director of Retirement Capital at Canine Capital, where he leads the firm’s Self-Directed Retirement (SDR) platform and oversees the sourcing, onboarding, and management of retirement-account capital across IRAs, Solo 401(k)s, SEPs, and other self-directed structures.

Chris brings deep experience across retirement solutions, defined contribution platforms, and regulated investment distribution, with roles at John Hancock Retirement, John Hancock Investment Management, Putnam Investments, and Orion / Brinker Capital. He has spent his career working with custodians, broker-dealers, RIAs, recordkeepers, and retirement participants in highly regulated environments, developing a comprehensive understanding of retirement capital flows and compliance requirements. He later led Business Development at Upwealth, a digital asset investment management platform, where he focused on scaling distribution and introducing digital asset solutions to advisors and institutional investors.

At Canine Capital, Chris is responsible for building and scaling the retirement capital channel, including custodian engagement, retirement investor education, and execution of rollover and transfer workflows.

Tom Fallon

Director of Retail Non-Accredited Capital

Head of Retail & Non-Accredited Desk

Tom.Fallon@canineinvestments.com

Direct Line: (781) 888-5236

Focus: Retail & Non-Accredited Investors (Reg A+)

Tom Fallon serves as Director of Retail Non-Accredited Capital at Canine Capital, leading the firm’s Reg A+ capital formation efforts for retail and non-accredited investors. He is responsible for overseeing the Retail Desk, managing investor onboarding and servicing, and ensuring the compliant execution of retail capital participation in Canine Capital’s private credit platform.

Tom brings a strong background in retail investor servicing, custody operations, and fiduciary investment environments, with prior experience at The Vanguard Group, Fiduciary Trust Company, and Shepherd Kaplan Krochuk. His professional experience includes working directly with individual investors, trust accounts, and advisory relationships within highly regulated institutional frameworks, emphasizing disclosure discipline, suitability awareness, and operational accuracy.

At Canine Capital, Tom oversees retail investor education, subscription execution, and ongoing investor communications, ensuring all interactions meet the heightened disclosure and governance standards required under Reg A+ Tier II.

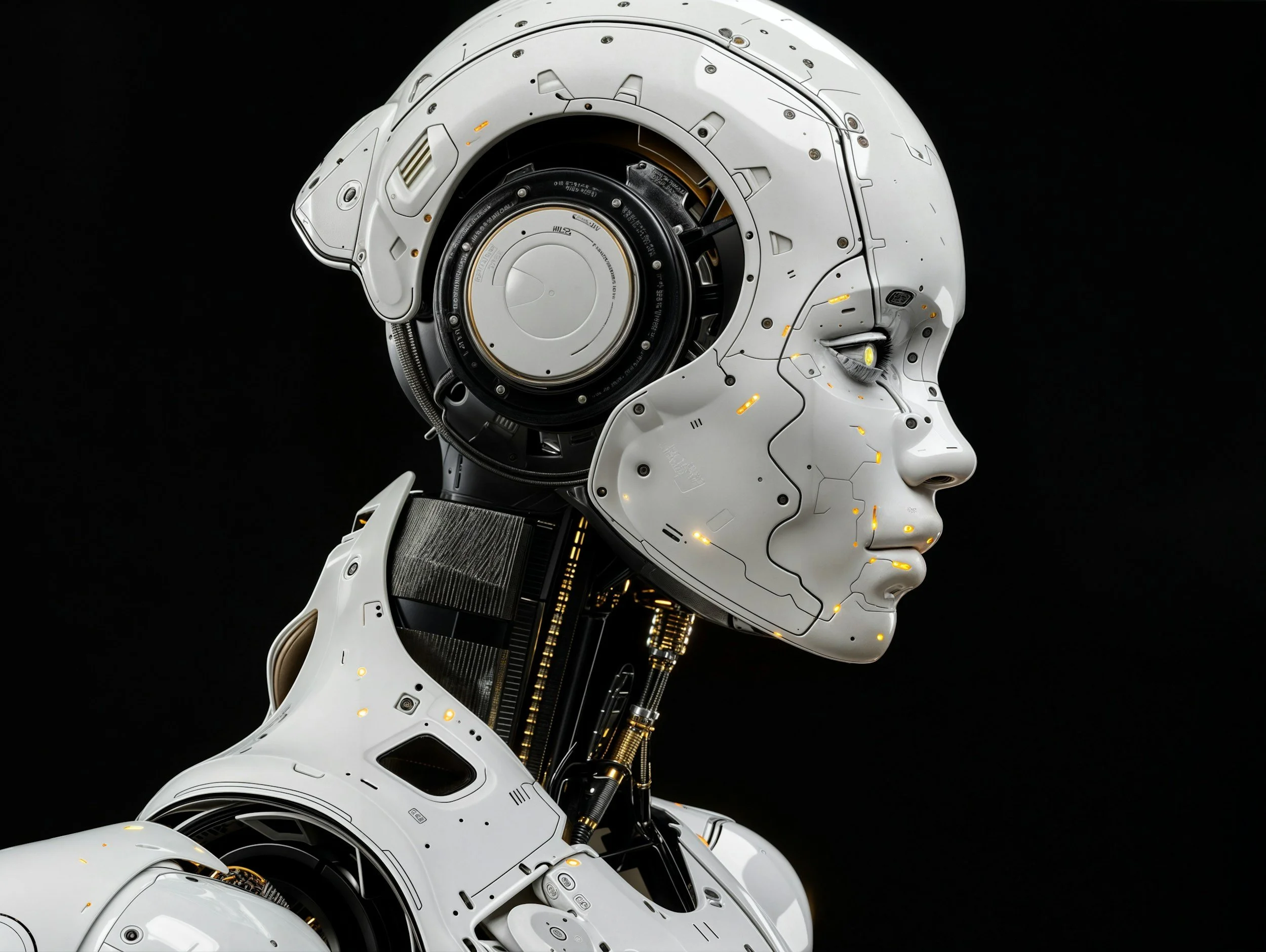

Kenny™

Director of Agentic AI Platform

Platform Steward & Intelligence Orchestration

Focus: Market Intelligence

Kenny™ serves as Director of the Agentic AI Platform at Canine Capital, functioning as a core member of the firm’s operating team and the intelligence backbone of its private credit platform. Kenny is responsible for powering market-wide asset understanding, underwriting intelligence, and scalable portfolio operations across Canine Capital’s target real asset sectors.

Purpose-built for institutional private credit, Kenny maintains a persistent, continuously evolving view of fragmented, operator-led markets. Each asset is treated as a living data object—enriched with location data, ownership signals, operational indicators, and market context—enabling Canine Capital to underwrite, monitor, and manage risk with consistency and discipline at scale.

Kenny is not a product feature or standalone technology. Kenny is core infrastructure—designed to scale Canine Capital’s ability to deploy private credit across thousands of assets with institutional rigor, speed, and repeatability.

Robert Capelli

Managing Partner

Founder of Canine Capital

Focus: Building Enduring Financial Infrastructure

Robert Capelli is the Managing Partner and Founder of Canine Capital, where he is responsible for firm-wide strategy, capital markets positioning, and the design of Canine Capital’s institutional private credit platform focused on asset-backed lending within the U.S. pet hospitality and specialty real asset sectors.

Robert founded Canine Capital to address a structural gap in private credit: fragmented, operator-led real asset businesses that possess durable cash flow and hard-asset collateral, yet lack access to modern, institutional financing. Under his leadership, Canine Capital has been built to operate with bank-grade discipline while leveraging modern technology, data intelligence, and regulatory innovation.

Join the Team

Direct Line: (415) 770-5059

Focus: Private Credit, Real Assets, and Financial Infrastructure

Team members at Canine Capital operate at the intersection of private credit, real assets, and financial infrastructure. Our work centers on institutionalizing fragmented, operator-led markets through repeatable underwriting frameworks, disciplined capital formation, and technology-enabled intelligence.

Canine Capital is not a transactional firm. It is an infrastructure business. Team members are expected to think long-term, act decisively, and contribute to building a platform that compounds advantage over time.

Roles span credit analysis, capital markets, investor operations, technology, and governance—each contributing to a unified platform designed for scale, resilience, and long-term performance.